|

BY FRED HOWARD ANNIS.

THE art and science of

life assurance has no higher or better exponents than have been given to

the world by Scotland.

The practice of this most

benevolent of man's institutions has been raised by Scotsmen to the

level of the liberal arts and refined to an exact science.

Two of the greatest life assurance

institutions in the world to-day are the Scottish Widows' Fund of

Edinburgh and the Standard Life also of that city which the sons of

Scotia so love to hear called "The, Modern Athens."

There is something in the Scotsman's genius

for finance that, coupled with his characteristic carefulness about

everything he does, especially in money matters, which peculiarly fits

him for excellence in the conduct and management of life assurance

companies. Scotsmen

carry this characteristic with them to every country they make their

own, and there's no denying they are the financial masters of more

communities, if not countries, than any other race of men, as witness

Canada and other parts of the British Empire, as Australasia; and also

the United States, where the most successful men in business and finance

to-day are Scotsmen.

How very clear this is, when Canada is the

country under consideration, may be seen when one surveys the financial

field and marks the men who are the executive heads of the leading life

assurance companies.

Of British life assurance companies whose

Canadian branches are managed by Scotsmen, the Standard Life is an

example in the person of Mr. W. M. Ramsay, Montreal.

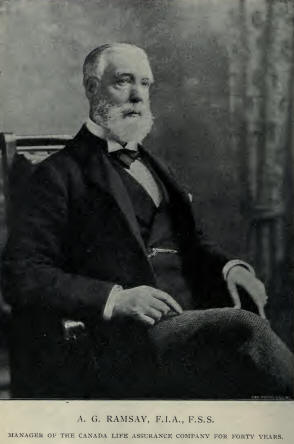

Canadian companies whose managers are

Scotsmen may be instanced by the Confederation Life in Mr. J. K.

Macdonald, the Sun Life in Mr. R. Macaulay, and especially the Canada

Life in Mr. A. G. Ramsay.

What is it about the Scotsman that has

enabled him to beat all competitors in the field of finance?

What is the essence or spirit of his genius

for making a success of whatever he turns his hand to when money is

concerned? Thrift

is the national trait of the Scot.

He is long-headed.

Putting by his savings against a rainy day

is typical of the man who proudly claims as his native land that

heather-blown country north of the Tweed.

Life assurance is simply co-operative

saving. The life assurance company is an aggregate of personal units,

each of whom gains by the added strength of the savings of all the

others. Hence the business of managing a life assurance company fits in

with the natural bent of the Scotsman.

For the purpose of enquiring into the reason

of this remarkable success of the Scotsman, in the special branch of

finance constituted by life assurance, perhaps the last named of the

three Canadian companies instanced, viz.: the Canada Life, is the best

illustration. No

other company so well illustrates the working out to a success of

international extent of Scotch ideas under American conditions as this

oldest and largest of our Canadian life companies.

Situated as the Dominion is, alongside the

great new-world republic, it necessarily followed that large influence

came from the south to temper the old country spirit of severely

conservative methods in life assurance.

The endowment form of policy is the most

conspicuous evidence of this American influence upon British practice,

for it was the United States companies that popularised this kind of

life assurance combined with safe investment.

Looking at the splendid success Mr. Ramsay

in forty years' continuous management, of the Canada Life has attained

by adhering to principles of honor and lofty ideals ingrained by his

early training in a famous Scottish life assurance institution, there is

beyond a doubt entering into the estimate of the various forces at work

the element of evolution evidenced in the adoption by the Company of

safe, progressive steps all along the line of its advancement to its

present pre-eminent position.

In no other way is this shown more

convincingly than in the modernizing of the Canada Life by moving the

head office to Toronto and in the attracting to the service of the

Company men who are skilled, each in his own department, in the

intricacies of life assurance finance.

It is interesting also to enquire how the

Scotsman's ideas of thrift have worked out in the case of the Canada

Life, which has been chosen for the purpose of illustrating the success

of the Scotsman in life assurance?

The actual figures running over a series of

years are accessible in the Government reports. These show a striking

result. Taking the last available twenty years— from 1878 to 1897

inclusive,—they show that the Canada Life received from policy-holders

$25,680,000. In return policy-holders have been paid $15,130,000; and

ledger assets accumulated during the twenty years, to pay prospective

claims of policy-holders, amount to $15,220,000. These two sums taken

together,—$30,350,000 —represent the total paid or credited to

policy-holders in that period. That is for every $100 received in

premiums during the last twenty years, the Canada Life has paid or

credited to policy-holders the sum of $118. This is one of the most

remarkable records in the history of life assurance.

If it be asked how the Canada Life

accomplished this, the answer is that by carefully investing its funds

on hand it was enabled to pay every dollar of its expenses of management

and stock dividends out of interest alone, and besides leave between

$4,000,000 and $5,000,000 of interest receipts for the benefit of

policy-holders.

Cobden's words about thrift are a propos. The building of all the

houses, the mills, the bridges, and the ships, and the accomplishment of

all other good works which have rendered man civilized and happy, has

been done by the savers; and those who have wasted their resources have

been their slaves."

Can there he a more apt example of thrift as

a national trait than the Scotsman's showing as a life assurance

financier? |